Paying Taxes

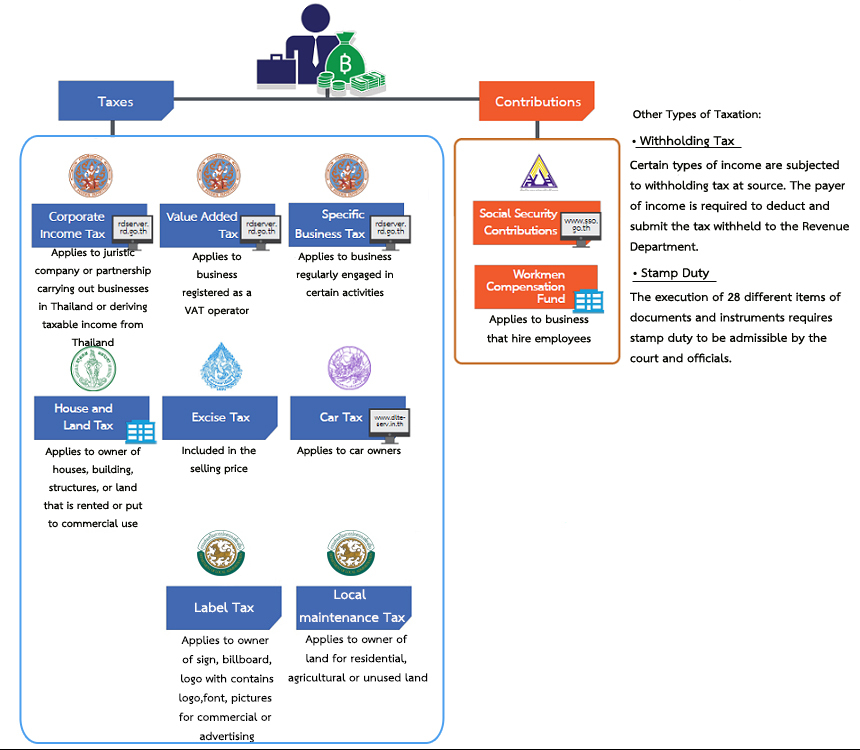

This section discusses taxes and mandatory contributions that businesses are subjected to pay.

Application Taxes and Contributions for Business:

Select your options

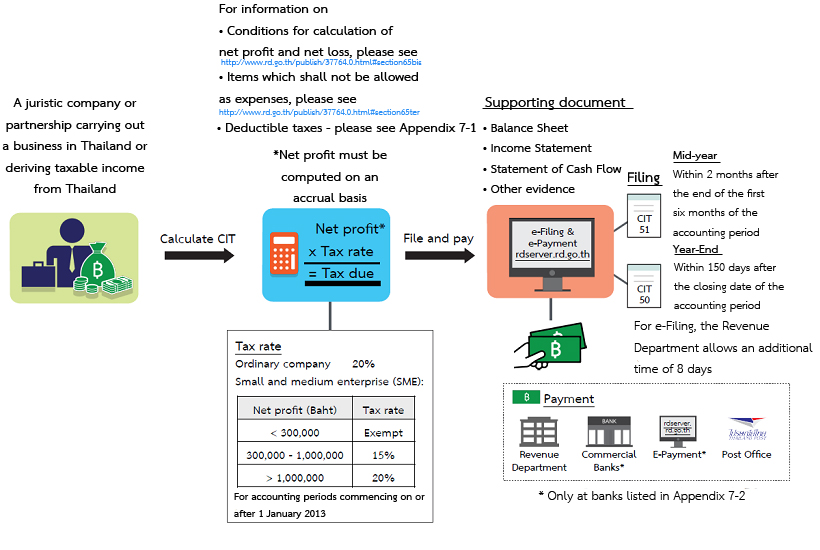

Corporate Income Tax

Corporate Income Tax (CIT) is a direct tax levied on a juristic company or partnership carrying on business in Thailand or not carrying on business in Thailand but deriving certain types of income from Thailand. A company or a juristic partnership incorporated under Thai law is Limited company, public company limited, limited partnership and registered partnership.

To claim a tax refund, the taxpayer must fill in the 'Request for Tax Refund' section in Form CIT 50 and certificated by the Director / Partner / Manager and affixed with the corporate seal (if any).

Last updated 29 February 2016

Source :

| RD : Corporate Income Tax | link |

| RD: Conditions for calculation of net profit and net loss | link |

| RD: Items which shall not be allowed as expenses | link |

| RD: Laws and Regulations (Revenue Code) | link |

| RD : e-Form Corporate Income Tax | link |

Download :

| Appendix7-1 | download |

| Appendix7-2 | download |

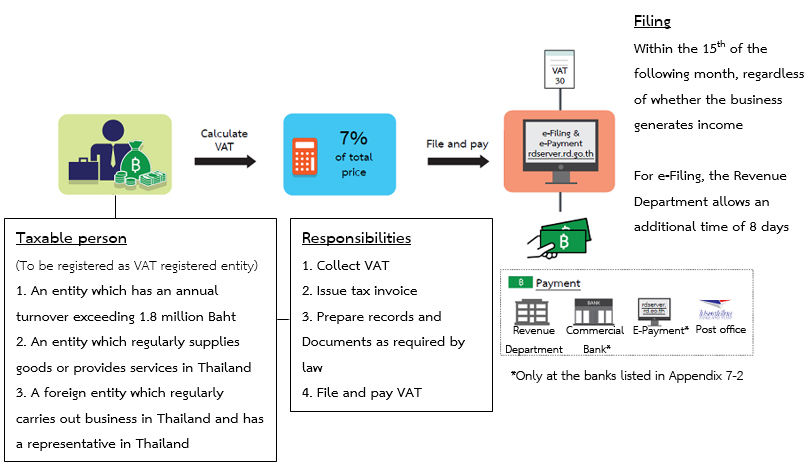

Value Added Tax

Value Added Tax (VAT) has been implemented in Thailand since 1992 replacing Business Tax (BT). VAT is an indirect tax imposed on the value added of each stage of production and distribution. Due to eliminate double taxation, neutral economy and conducive to investment, exports, and a mechanism to prevent tax evasion. Thailand has set up the VAT rate at 10 percent, but has issued a decree reducing to remain to 7 percent.

To claim a tax refund, the taxpayer must fill in the 'Request for Tax Refund' section in Form VAT 30. Otherwise, it will be deemed as a tax credit in the following month.

Last updated 29 February 2016

Last updated 29 February 2016

Source :

| RD: Value Added Tax | link |

| RD: Laws and Regulations (Revenue Code) | link |

| RD : Value Added Tax Return under the Revenue Code (P.P.30) | link |

Download :

| Appendix7-2 | download |

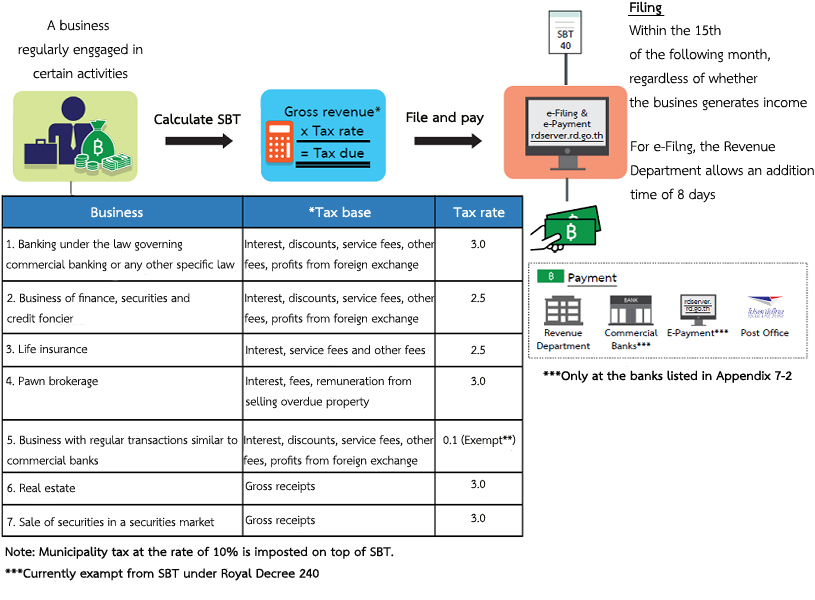

Specific Business Tax

Specific Business Tax (SBT) is another kind of indirect tax introduced in 1992 to replace Business Tax. Certain businesses that are excluded from VAT will instead be subject to SBT. The Code sets out various activities to specific business tax registration. Please see further information about Specific Business Tax which is provided by the Revenue Department, Ministry of Finance, according to follow:

To request a tax refund, the taxpayer must fill in Form Kor.10

Last updated 29 February 2016

Last updated 29 February 2016

Source :

| DBD: Electronic entity name reservation system | link |

| RD: Laws and Regulations (Revenue Code) | link |

| RD: Tax refund Form Kor.10 | link |

| RD : Revenue Department | link |

| RD: e-Form Specific Business Tax Return under the Revenue Code (P.T.40) | link |

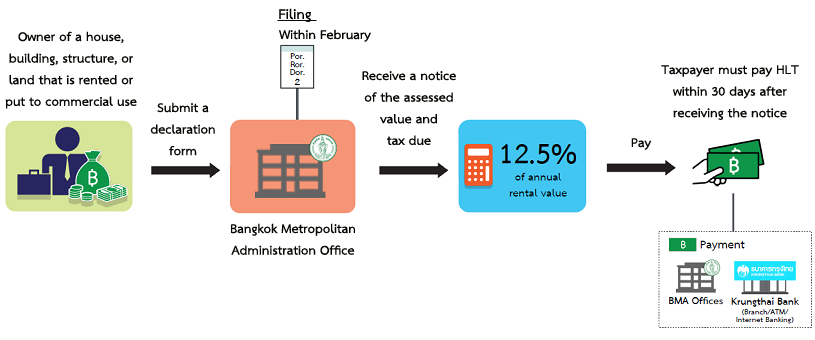

House and Land Tax

The law requires person who leases out land, or land and buildings, including condominiums, is subject to House and Land Tax at the rate of 12.5% of the actual or assessed rental value, whichever is higher at the municipal office of the area, which house or building is located within February every year. Owner occupied factories and commercial buildings are assessed for this tax at the same rate, according to the assessed rental value.

Annual value is the amount for which the property should be rented in one year. If the property is rented to assume that the rental fee is annual. But if that is the case, the officer has reasonable cause that the rent shall not take a reasonable amount of money to rent or as is the case for the rent of the property is not informed because the process itself, the authority has estimated annual value of assets into account the nature, location and size of the property is public benefit.

Evidence of the required house and land tax refund

1. The title deeds building house

2. The sale contract, rental or land, and buildings land.

3. Building Construct License Building permits

4. The House Number

5. Copy of the House registration of the owners. Copy of house registration of greenhouses that tariff

6. Identification card or official ID card or state enterprise employee card

7. Tax Identification Number / Registration of Trade number

8. Proof of business registration certificate, such as business registration, Registration of Trade, commercial registration

9. Copy of the financial statement (in case of a legal entity)

10. Document of revenue, such as PP 01, PP-09, PP 20

11. License and / or operation of the plant

12. License installation of machinery

13. License of Environmental and Sanitary Section

14. Install water supply and electric receive

15. The tariff building lease

16. Power of Attorney (in case can't be filed with the law stamp duty)

17. Other document relating to the use of tariff building

Note to the recipient or the owner of building must copy the documents that relates to above with signature to obtain all documents to file at the Bangkok District Office

For more information, please see further for Bangkok Area Tel. 1555 for area which outside Bangkok, please contact Local Administration at that area

Source :

| Ministry of Finance: Property tax and land | link |

| Bangkok: Finance Bureau Bangkok | link |

| New Land and Building Tax Act B.E. 2562 in Thailand | link |

| RD: Application VAT revising by fiscal code Phor.Por.09 | link |

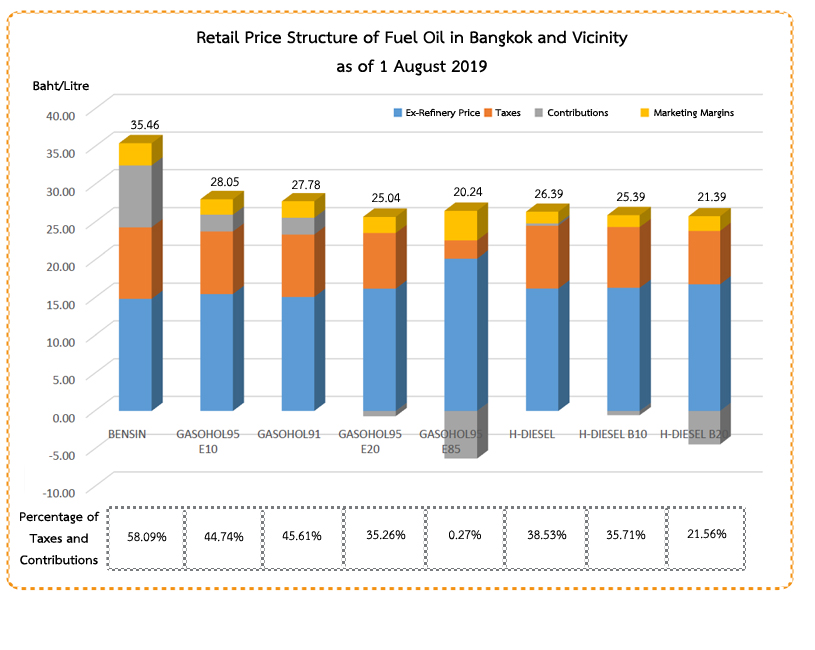

Excise Tax

Retail price of fuel oil comprises of 1. Excise Tax, 2. Tax for the Ministry of Interior (10% of excise Tax amount ), 3. Value Added Tax (7% of wholesale price and marketing margin), 4. Contribute to Oil Fund and 5. Contribution to Energy Conservation Promotion Fund. The government charges these taxes and contributions from producers and importers of oil.

Excise Tax is imposed on the sale of a selected range of commodities whether manufactured locally or imported. Tax rates are based on ad valorem or a specific rate, whichever is higher than normal intake may cause adverse effects on health and morality. Tax liabilities arise on locally manufactured goods when leaving the factory and at the time of importation for imported goods. As follow :

1. Excise Tax Act, B.E.2527 (1984) : Electrical Appliance, Beverage, Yacht and boat, Automobile, Marble and Granite processing, Golf course, Nightclubs and Discotheques, Turkish bath or sauna and massage, Perfume and Cosmetics, Oil and Oil Products, Glass and Glassware, Carpet and other floor covering textile, Motorcycle, Battery, Horse Racing Course, Lottery/Tax exempted, Land line telephone service (currently exception)

2. Liquor Act, B.E.2493 (1950) : Steeped liquor, Distilled liquor, Ethanol

3. Tobacco Act, B.E.2509 (1966) : Tobacco

4. Playing Cards Act, B.E.2486 (1943) : Cards

Persons responsible for paying taxes on merchandise

1. Industry entrepreneurs

2. Entertainment service providers

3. Product importers

4. Other persons designated by Excise Tax Act, B.E.2527 (1984) as follow :

4.1 Vehicle modifiers (Section 144, fifth)

4.2 Owners of bonded warehouses (Section 42)

4.3 Industrial entrepreneurs or entertainment service providers newly established through mergers or industrial entrepreneurs or entertainment service providers established through transfers from the former entrepreneurs (Section 7)

4.4 Persons receiving privileges in accordance with Section 102 (3) merchandise for which industry entrepreneurs receive tax refunds or exemptions (Section 12 subsection 2(2))

4.5 Persons having the right for exemptions or reductions of tax rates for imported merchandise (Section 11, subsection 2(2), (3))

4.6 Persons transferring and transferees receiving privileges in accordance with Section 102 (3) that industry entrepreneurs receiving tax refunds or exemptions (Section 12, subsection 2(1))

4.7 Persons transferring and transferees of imported merchandise receiving tax exemptions or reductions (Section 11, subsection 2(1))

4.8 The representative of the heir or the heir receiving an inheritance in the form of imported merchandise with tax exemptions or reductions (Section 11, subsection 2(4))

4.9 The representative or the heir, the heir, the possessor of the inheritance or guardian (Section 56)

4.10 The representatives of industrial and entertainment limited companies qua juristic persons who were liquidators, managing directors, or managers prior to the termination of said industrial and entertainment limited companies businesses (Section 58)

4.11 Offenders in accordance with Sections 161, 162 (Section 163)

For more information, please see further at The Excise Department Tel. 1713 or 02-6686618

Source :

| RD : Revenue Department | link |

| EPPO: Energy Policy and Planning Office Ministry of Energy Thailand | link |

| EXCISE: The excise department | link |

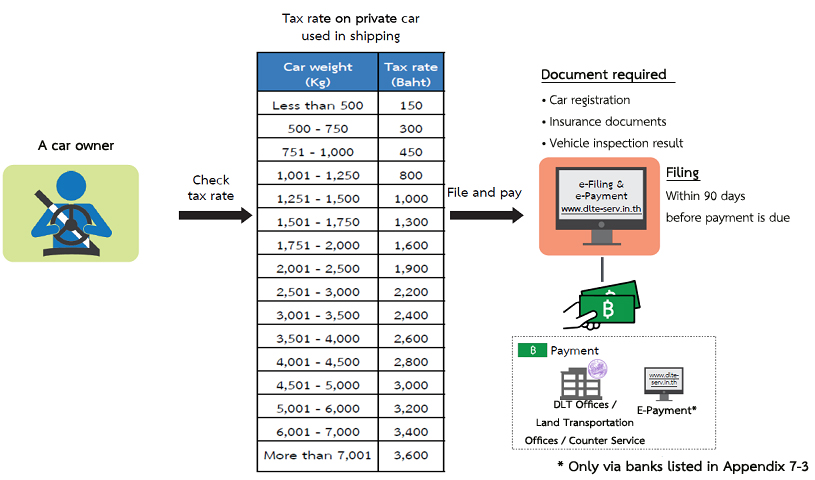

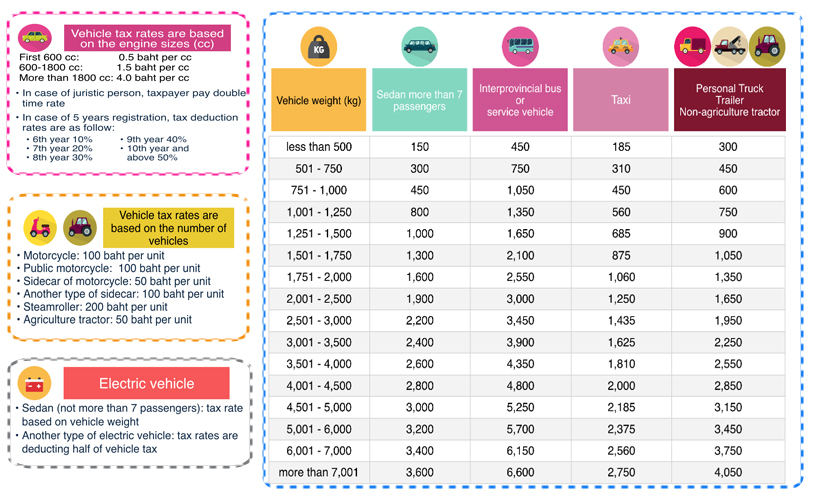

Car Tax*

*For a medium-size truck used to deliver products, which weighs 15,300 kilos when loaded.

According to Land Transport Act, B.E. 2522 and other as amended impose the owners of the cars will be taxable for annual. The current tax rate is prescribed for each vehicle type.

Source :

| Department of Land Transport | link |

| Krisdika: Land Transport Act B.E. 2522 | link |

| Krisdika: Road Accident Victims Protection Act B.E. 2535 (1992). | link |

Download :

| Appendix7-3 | download |

Withholding Tax

Certain types of income paid to companies are subject to withholding tax at source. The withholding tax rates depend on the types of income and the tax status of the recipient. The payer of income is required to file the return (Form CIT 53) and submit the amount of tax withheld to the District Revenue Offices within seven days of the following month in which the payment is made. The tax withheld will be credited against final tax liability of the taxpayer. The following are the withholding tax rates on some important types of income.

Filing tax returns via the Internet (e-Filing) of the Revenue Department

Nowadays, The Revenue Department has been encouraging Thailand companies and other Thai tax payers to adopt Tax Returns online (E-filing) to facilitate the taxpayer. The taxpayer can fil a tax return for all types of tax (Personal Income Tax, Corporate Income Tax, Value Added Tax, Specific Business Tax) with a few steps of procedure. The legal entities that are interested in the service must to complete procedure as follow:

1. To start filing tax online, a taxpayer has to file form Por Or 01 "Application Form to file tax returns via the internet” which has the name, address, tax ID and contact information of the tax payer, on the Revenue Department’s website.

2. Select the "channel of the tax" will be selected for the purpose of

3. Print a Por Or 01 indicates a reference to the registration and filing of the agreement tax form for the authorized to sign and stamp juristic partnership’s seal (if any) on every page.

4. Prepare documents that is used to submit the request is to fill and pay tax payment via Internet Por Or 01 as follows:

4.1 Terms of filing and paying tax payment via the Internet.

4.2 If a legal entity must attach a copy of the certificate or photo of the currently Registrar partner for a period not exceeding 6 months from the date that the Registrar partner signed and a photo identification card, or alien certificate of juristic person with it authority signed in a copy of the certificate or photo.

4.3 If the power of attorney on behalf of others, must prepare a power of attorney and attach a photo identification card of the shareholder and attorney with signature in.

5. Within 15 days after filing that form following Por Or 01, the taxpayer has to physically submit the following documents under Article 4 to

1) The Electronic Tax Filing Management Office of the Revenue Department, Revenue Department Building, 27th Floor, to get username and password in the day that you sent all documents

2) Provincial Revenue Office Area where the establishment is located outside Bangkok to get username and password via the address that registered.

6. For Approval to use the service "file and pay taxes via Internet", the Revenue Department will inform you of the approval and filing tax via Internet by e - mail address that stated in the register or check at Revenue Department e-services

For more information, please see further at The Revenue Department Tel. 1161

Source :

| RD: e-Service | link |

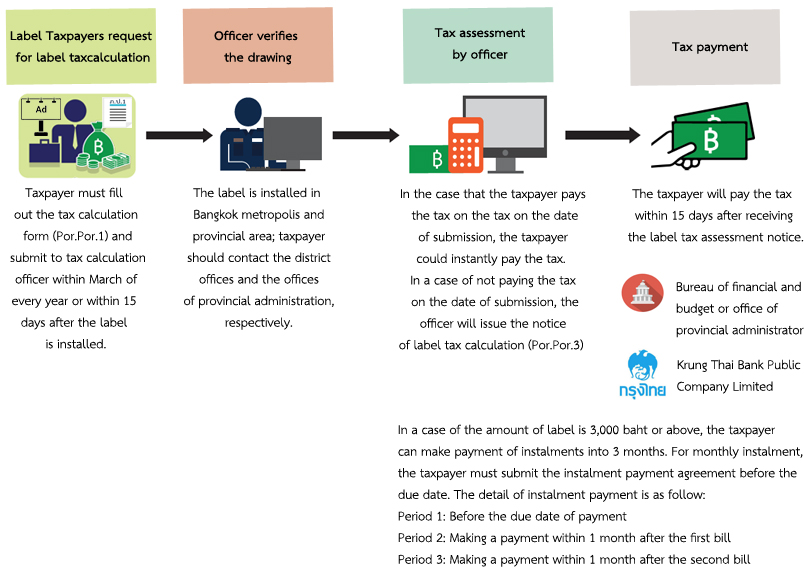

Label Tax

Labels Tax is a tax collected from its various banners and advertising.

Taxable Label, which label name, brand, mark, is making for merchant or other business or commercial, or advertising revenue to other parties in order to find revenue whether it's advertising or display any of the subjects with ideographic writing marks or inscriptions carved or made to appear in another way is taxable.

Non-taxable Label

1. The label shown at theaters and area of the theater to advertise.

2. The label displayed on pallet or wrapped or packaged item.

3. Signs displayed at the event held occasionally.

4. Signs displayed on people or animals.

5. Banners displayed on buildings used for commercial or other business or private spaces within the building, which is in order to earn money, and each label has size is not more than 3 square meters prescribed in the regulations. It does not include the law on commercial signage.

6. Signs of central government Provincial or local government according to Government Administration Regulations

7. Signs of organizations established under the Law on the Organization of the government or the law on the other. And agencies that bring revenue to the state.

8. Signs of the Bank of Thailand, Government Savings Bank, Government Housing Bank. Cooperative Bank and the Industrial Finance Corporation of Thailand.

9. Signs of private schools According to the law on private schools or private higher education institutions. Under the Private Higher Education Institutions listed as a building or area of private schools or private institutions.

10. Signs of enterprises which trade and agricultural productivity caused by its agriculture.

11. Signs of a measure or operation for the benefit of religious, charitable or public purpose.

12. Signs of association or foundation

13. Label as defined in the regulations.

The current Regulation No. 2 (2535), the owner signs a tax badge.

13.1 signage installation or to a private car. Rollers motorcycle or tractor. Under the car

13.2 signage installed or listed under the scroll wheel.

13.3 signage installation or to a vehicle other than (13.1) and (13.2), with an area less than five square centimeters.

Tax payer is an owner of the label, but in the case that no one filed label tax and the officer could not find the owner sign it shall be deemed occupiers therefore has a duty to tax the label labels. If can’t find a person who is a badge, an owner or occupant of a building or land on which the label is installed, is a tax payer and the officer will report in letter of assessment to that person.

If the owner of label is outside the country, the representative or agent inside the country is responsible to fil a tax instead of the owner. If the owner of label is pass away, a missing person, disable person or etc., Executors and administrators, trustee, inheritor or other is a representative of the owner of label.

The period of filling tax

The owner who are label tax payer is filed label tax form to Revenue Section of District Office where the label is installed within March of every year. Newly Label or has changed, the owner has payment during March or 15 days every year after label installation or has changed is date for submitting document except the label was installed or filed tax in the first year or until the end of the year in period within each of 3 months of the year by starting with the tax period since the signage until the last period of the year.

- New installed advertisement label is to file tax form (Pho. Por. 1) within 15 days

- Label which pay annual tax is to file tax form (Pho. Por. 1) from January to Mach every year

- Label which pay annual tax that want to change the label has inform within 15 days

- If you want to take label off because of insolvency, please inform in December every year

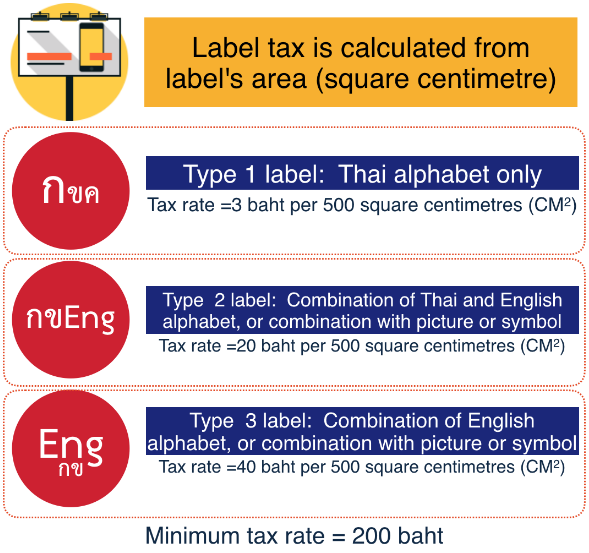

Tax base and tax rate

Label Tax Base is calculated from label’s area (square centimeter) and tax rate is calculated from type of label such as Thai Language Label, Foreign Language label or Picture

In the case of label which defined frame, tax rate is calculated from label’s area (multiplied by widest and longest of frame)

In the case of label which not defined frame, tax rate is calculated from characters, picture or symbol which is at edge of frame to define the widest and longest part, then calculate following:

Required Document for filed the form

The new label, the owner is file label tax form with document which a signed authentication as follow :

1. Installed label license, Label receipt

2. Copy of House Registration

3. Identification card, Official ID card, state enterprise employee card, tax payer ID card

4. If the label which is a legal entity, is attach with a certified certificate of registration partnership and company, commercial registration and document of Revenue, such as PP 01, PP-09, PP 20

5. Power of Attorney (in case can't be filed with the law stamp duty)

6. Other document following the officer’s suggestion such as Photo of label, size measurement

The old label (within 15 days from the date of notice of assessment)

1. Label tax payment form) of previous year

2. tax payment receive of previous payment

3. In case of juristic person, the registrant must submit certificate of Office of the Company Limited and Partnership and Label tax payment form

Overdue tax payment

1. In case taxpayer is not able to pay in March or 15 days after label installation, taxpayer must pay amount 10% of normal tax calculation.

2. In case taxpayer attempt to submit incorrect tax calculation form and pay the tax less than normal calculation, taxpayer must pay amount 10% of normal tax calculation

3. In case taxpayer is not able to pay within 15 days after receive tax calculation notice, taxpayer must pay amount 2% per month of tax.

Label tax appeal after receive tax calculation notice

Taxpayer has to appeal the incorrect tax calculation notice to Bangkok governor. The Taxpayer can appeal to officer at Division of financial, District office within 30 days after receive tax calculation notice. the appellant must submit case within 30 days. If the appellant does not follow the procedure with irrationality, the Bangkok governor or authorized person have right to dismiss the appeal. The appellant have right to appeal to the court with 30 days after received the Bangkok governor decision, if the appellant disagree with the decision. This appeal is not include the dismiss the appeal case as previously describe. The appeal is not respite of execution. In case of tax refund from court decision, the officer must immediately inform taxpayer to get tax refund within one year after receive the notice. The taxpayer who pay the label tax without tax obligation or overpaid, the taxpayer can submit the appeal within one year after paying label tax.

Paying the penalty charge

The taxpayer must pay the penalty charge as follows:

1. In case of overdue, taxpayer must pay amount 10% of normal tax calculation. If taxpayer can pay before receive notice, pay amount 5% of normal tax calculation.

2. In case taxpayer attempt to submit incorrect tax calculation form and pay the tax less than normal calculation, taxpayer must pay amount 10% of normal tax calculation

3. In case taxpayer is not able to pay within 15 days after receive tax calculation notice, taxpayer must pay amount 2% per month of tax.

Legal punishment

1. Taxpayer deliberately submit false tax calculation form in order to deduct label tax payment, taxpayer must be punished with imprisonment not exceeding one year or fined from 5,000-50,000 baht or both.

2. Label which installed on the property of another person and label's size more than 2 square meters, must have name and address of label's owner at bottom right corner of the label. If the taxpayer does not comply, taxpayer must be fined 100 baht over a time when the offence was committed.

3. Taxpayer must inform label transfer notification within 30 days after transfer date and must show tax payment receipt. If the taxpayer does not comply, taxpayer must be fined 1,000-10,000 baht

4. If taxpayer interrupt the operation of officer or does not comply with letter of notice, taxpayer must be punished with imprisonment not exceeding 6 months or fined from 1,000-20,000 baht or both.

5. If taxpayer does not deliberately submit tax calculation form, taxpayer must be fined 5,000-50,000 baht

For more information

Bangkok metropolis: call 1555 or address of distract office

Outside Bangkok metropolis areas: contact provincial office

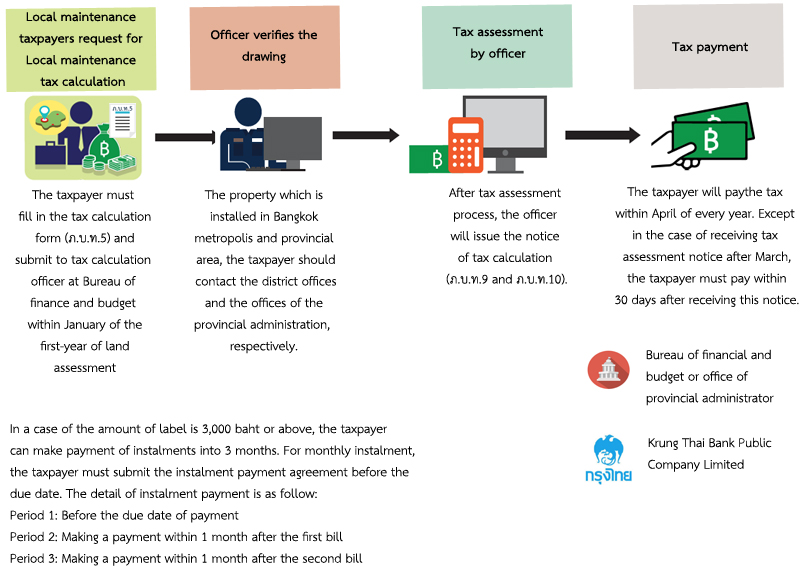

Local Maintenance Tax

Local maintenance tax is tax charged from land use such as land for housing, agriculture, and wasteland.

List of non-taxable lands

1. The land of Royal palace

2. The land for public utility

3. Land of local government used in the affairs of the local government or public.

4. The land used for public nursing, education or public charities.

5. The land used for religious practices.

6. The land used as a public cemetery without benefit.

7. Land that used in railway, water, electricity, airport or the port of the state.

8. Land that used for taxable real estate.

9. Private land that donated for public utility.

10. The land for the United Nations, the specialized agencies of the United Nations or another international organization

11. The land for the embassy office or consulate

12. Land that prescribed in ministerial regulations.

Tax Base and Tax Rate

Tax Base is the average price of land that set up by the board appointed by the Governor of Bangkok. Normally, has to pay tax in accordance with the local maintenance tax act which specifies by the location of the land. The current average price that used to assess the local maintenance tax has been used since B.E. 2521-2524. The minimum price is the average price 1,600 Baht per Rai, Tax rate is 8 Baht/Rai. The maximum is the average price 9,000,000 Baht per Rai, Tax rate is 22,495 Baht/Rai. The agricultural land that is used to plant only herbaceous plant has to pay half of tax rate. If the land owner does planting on their own, the tax rate that has to be paid is not over 5 Baht/Rai. The land that is left empty or is not used for any benefit as it should be used, the tax rate that has to be paid is double. Apart from this, there is the abatement of tax, in the case that the land owner uses the land for living, raising animals and farming, the land owner will have the right to apply for abatement of local maintenance tax in different rate depending on the area. For the land located in Bangkok, could download more documents here [Thai only]. For the land located in the area outside Bangkok, please contact local administrative organization.

Required Documents

On the 1st of January of any year, the land owner has a duty to pay local maintenance tax in that year and has to submit land list declaration form (Por.Bor.Tor.5) to assessment officer at the district office that the land is located.

In the case of the new land or the year that calculated as median land price, The land owner has to submit tax payment form within January of the year that median land price is calculated or every 4 years or within 30 days in the case of receiving the proprietary rights or changing the usage of the land. Por.Bor.Tor. 5 form has to be submitted with the copies of documents as follow:

1. Title deed

2. House registration

3. Personal Identification Card / Official Identification Card / State Enterprise Officer Identification Card / Taxpayer Identification Card

4. In the case that the land owner is juristic person, certificate of the Company Limited and Partnership Registration has to be attached.

5. Letter of power of attorney with stamp duty (in the case that the land owner could not submit)

In the case of the old land, The land owner has to pay the tax within April of every year and has to bring the receipt of the latest tax payment for indicating too.

If there is any change in the land or change the owner and it is affect the rate of local maintenance tax, the land owner has to inform the officers within 30 days from the date of changing.

For appealing on local maintenance tax, the land owner could appeal in 2 cases;

In the case that the land owner does not agree with the median land price and in the case that the land owner agrees that the estimate rate of local maintenance tax is not correct. The land owner has to appeal to the Governor of Bangkok by do submitting to the officers on the following periods;

1. The owner of the land has the right to appeal about the median price of the land within 30 days from the announcement of the median price.

2. If the land owner does not agree with the estimation, the land owner could appeal to the Governor of Bangkok at the district office within 30 days from the date that being informed.

3. The Governor of Bangkok consider the appeal, and inform in writing to the appellant.

4. If does not satisfied with the result, can be filed with the court within the 30 days from the date notified.

In the case of appeal or a final judgment of the court to reduce the estimated amount, the taxpayer has to be inform as soon as possible so that the taxpayer could receive the return payment by submitting the request within one year since the date notified. If the one pays local maintenance tax but does not have the duty to pay or pay more amount than it should be, the payer should have the right to receive the return payment within one year since paying the tax.

Surcharge

The local maintenance taxpayers have to pay the surcharges apart from paying taxes by the cases and the rates as follows:

1. Do not submit the form within the time limit. Pay an additional ten percent of the amount subject to tax. But if submit before receiving the notice, has to pay additional five percent of the amount subject to tax.

2. Submit the form incorrectly and cause in paying less tax, has to pay additional five percent of label tax that is additionally estimated.

3. Informing the incorrect amount of land and cause in the tax reduction, has to pay double amount of the estimated tax.

4. Do not pay the tax within the time limit, has to pay additional 24 percent per year of the amount that has to pay.

Legal Punishment

1. Purposely tell false statements or shows false evidence to avoid local maintenance tax is liable to imprisonment for up to six months or fined not exceeding two thousand baht, or both.

2. Intentionally not come, or refuses to identify the area of land is liable to imprisonment for not more than one month, or a fine not exceeding one thousand baht, or both

3. Intervenes the officers on land survey work or accelerate local development tax arrears is liable to imprisonment for not more than one month or a fine not exceeding one thousand baht, or both.

4. Violation of the order shall be liable to imprisonment for a term not exceeding one month, or a fine not exceeding one thousand baht, or both.

5. If there is a mistake and should not be penalized by imprisonment, there should be pay a fine within 30 days instead.

For more information

For Bangkok area, please contact call center 1555 or find address or telephone number of district office

For the area outside Bangkok, please contact Local Administrative Organization or find the location of Local Administrative Organization

Select your options

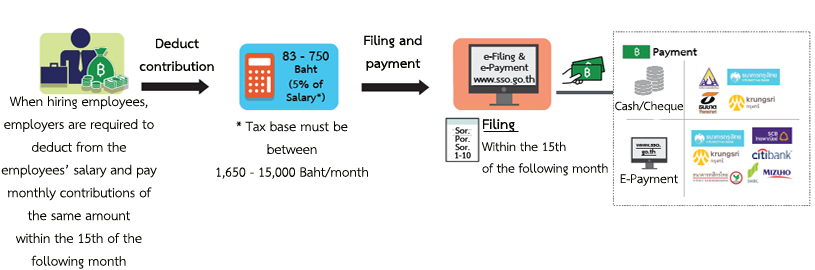

Social Security Contributions

Employer with at least 1 or more employees must register the employer registration and employee registration as insured person within 30 days. When employer increases more employees, must register new employee within 30 days at the same time. Employer must deduct money when paying wages to employees and contribute the money that is equal to total amount of the deduction from employees. Moreover, the Employer should create report according to Social Security office form 1 – 10 (part 1) and 1 – 10 (part 2) or create this form and save into disc or send this form by internet. The social security contribution should be paid by cash or cheque within the 15th of next month by sending together with the documents at any branch of Social Security Office or sending by post or sending at a branch of Krungthai bank Company Limited, Krungsri bank Company Limited and Thanachart bank where the company is located .

Contribution delivery have 2 methods as follow:

1. Filling in social security office form 1 – 10 (part 1) and 1 – 10 (part 2) form by yourself, send contributions with form of social security office form 1 – 10 (part 1 and part 2) by filling detail in Security office form 1 – 10 (part 2) as composition.

- Identification Number that should be filling completely.

- Surname – last name of the insured person with the explicit title.

- Filling wage actually with subsidy report.

Contribution Calculation in 3) if employee gets wage less than 1,650 Baht that calculation from 1650 Baht but if employee gets wage more than 15000 Baht by multiply with contribution rate that must be delivered. For contribution (small change) which have more than 50 stangs, should up to be 1 baht if less than 50 stangs, should be disregarded.

2. Contribution delivery by electronic information media by filling the detail in form of Social Security office 1 – 10 (part 1) completely and make the report in form of Social Security office 1 – 10 (part 2) in Diskette or Internet.

Obtain program or Format that subsidy information at any Social Security office or Download at Social Security office website. In case of corporate which have benches and try to filing form of Social Security office 1 – 10/1 which summary report that show subsidy delivery of each of benches to filling Social Security office form 1 – 10 part 1 and part 2.

Contribution delivery for monthly wage that should delivery within 15 of next month. By delivery at Krungthai bank Company Limited or Krungsri bank Company Limited or any Social Security office where corporate located or subsidy payment by e-payment of Krungsri bank Company Limited Citibank Company Limited and Sumitomo Mitsui Banking Corporation Limited at electronic services, Social Security office.

In Case of employer filling Social Security office form (1 – 10) which not correct that officer have authority to order employer to filling form completely. If employer does not do, will be guilty as penalty to prison at most 1 month or adjusted at most 10000 Baht or both.

If contribution delivery is not on time or no fully, employer should responsibility to pay more in 2% rate by month of unsent money or not full amount and employer must pay at Social Security office of province only.

For more information, please contact the Social Security office, Call Center 1506

Source :

| MOL: Social Security contribution Payment | link |

| Social Security Office | link |

| Krisdika: Social Security Act B.E. 2533 (1990) | link |

| MOL: Labour Protection Act B.E. 2541 | link |

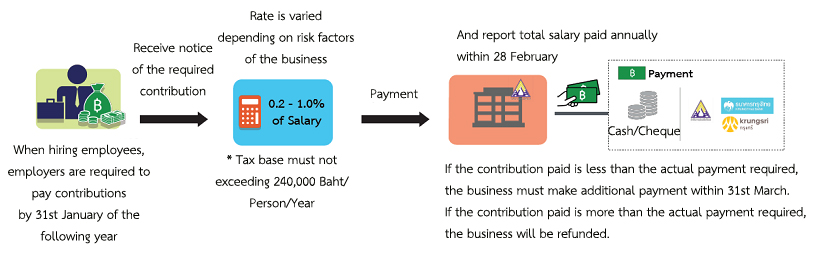

Workmen Compensation Fund

Compensation Fund have objectives to pay the compensation to employee who get injury, sick or dead because of working as well as protect the benefit for employer or get sick because of the condition of job or from working for employer. The employer who has more than 1 employee, should pay subsidy to employee who working for employer and get wage but excluding the employee who does housework which is not related to doing business.

** Employer who has at least one or more employees should register employer registration and employee registration within 30 days **

Subsidy billing and Subsidy calculation.

Employer should pay subsidy annually.

- Subsidy calculation is from wage that employer pay to employee no more than 240,000 Baht annually.

- Subsidy provisions are depending on risk of business of employer.

- When employer pay subsidy 3 year continuously. In the 4th year Subsidy is calculated from Loss rate for subsidy rate by experience then it will be billing in the 5th year. If employer who provides security for employee that will be decrease subsidy rate and employer who does not provide security for employee that will be increase subsidy rate. Anyway increase or decrease of subsidy rate will be calculated from main subsidy rate of employer.

- Employer who gets approved to instalment of subsidy, should pay deposited as 25% of subsidy within January and pay subsidy as 4 times within April, July, October, and next year in January.

- Within February of every year, employer must inform all wage amount of last year that actually pay to employee as follow form for calculating subsidy correctly and low subsidy delivery within March, 31st of every year.

Added money in case of employer does not pay subsidy within time limit or does not pay full amount who must pay more money at 3% monthly of overdue subsidy.

Refund to the employer that employer who pay subsidy or added money excessively from any causes that officer should inform employer for getting added money back.

Compensation means money that pay for compensation of working, medical expenses, the rehabilitation from working, Funeral expenses as 4 types follow

- Compensation in case of employee could not work 3 days continuously from injuries.

- Compensation in case of loss of some organs.

- Compensation in case of Disability.

- Compensation in case of dead or lost.

Compensation right after the end of the employee status, In case of injuries after the end of the employee status, the employer should filing a request of compensation within 2 years since the known dates of illness.

Employer who does not proceed by following the laws, regulations and disclosure of the facts of employer according to Compensation Fund Act, may be penalties and fines.

The benefit of Compensation Fund such as Disability case because of working and injury case or having disease because of working.

For more information, please contact the Social Security office, Call Center 1506

Source :

| Krisdika: Social Security Act B.E. 2533 (1990) | link |

| MOL: Workmens Compensation Act B.E. 2537 (1994) | link |

| MOL: Labour Protection Act B.E. 2541 | link |