คำถามที่พบบ่อย - การขอใบอนุญาตประกอบธุรกิจ

The easiest way to conduct this business under Thai’s company is suggested. According to Thai’s law, a company will consider as Thai when equal to or more than 51% of the company’s shares held by Thai nationality (whether juristic person or natural person).

Accordingly, if more than 49% of the company’s shares help by foreigner will consider as foreign company. Please see the attached file of Foreign Business Act B.E. 2542 (1999) section 4 for more detail regarding on this part. Following tables are main step to set up a business in Thailand.

| Step | Thai Company51%+ of company’ shares held by Thai nationality | Foreign CompanyMore than 49% of the company’s shares help by foreigner |

|---|---|---|

| 1 |

Business Registration with Department of Business Development, Ministry of Commerce There are several type of business organization in Thailand, please access;https://www.dbd.go.th/dbdweb_en/main.php?filename=index for more information. If you which to do a business in:Phuket, please contact:Phuket Commercial Registration OfficeTel. +66(0) 76 217406Rattanakosin 200 Pee Road, Muang, Phuket 83000 Phangan, please contact:Surat Thani Commercial Registration Office27/8 Talardmai Rd, Talard, Muang, Surat Thani 84000 Tel: 0 7728 1328, 0 7728 2584 Fax: 0 7721 0303 E-mail:suratthani@dbd.go.th **If you which to do a business as natural person, you can also register a commercial certificate with a city council**Business Registration with Department of Business Development, Ministry of Commerce There are several type of business organization in Thailand, please access:https://www.dbd.go.th/dbdweb_en/main.php?filename=index for more information. |

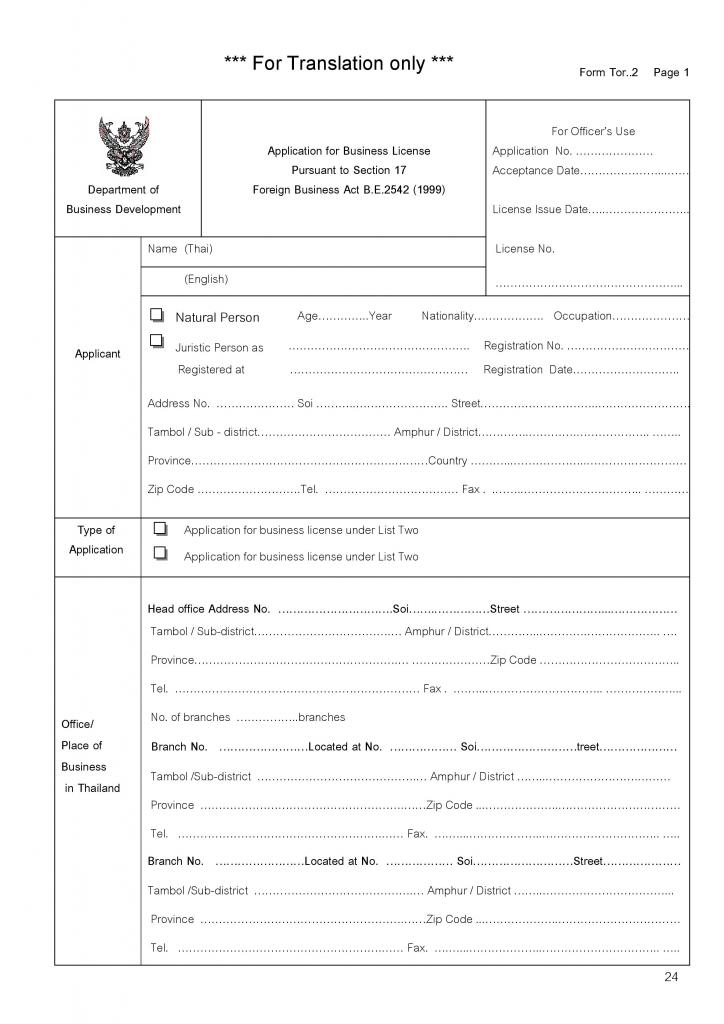

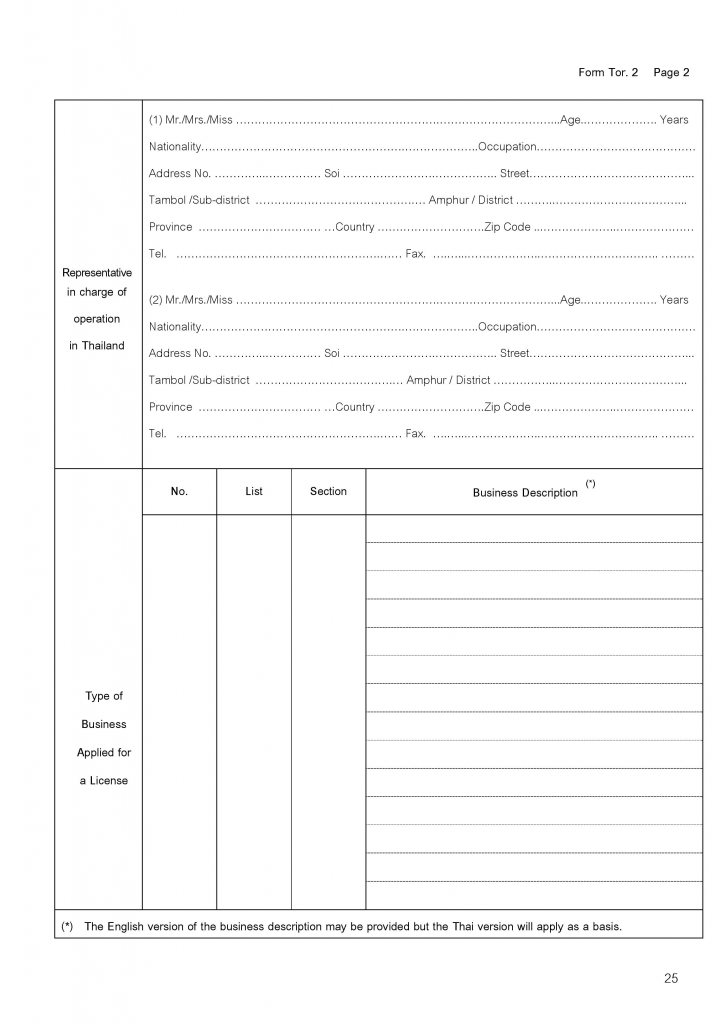

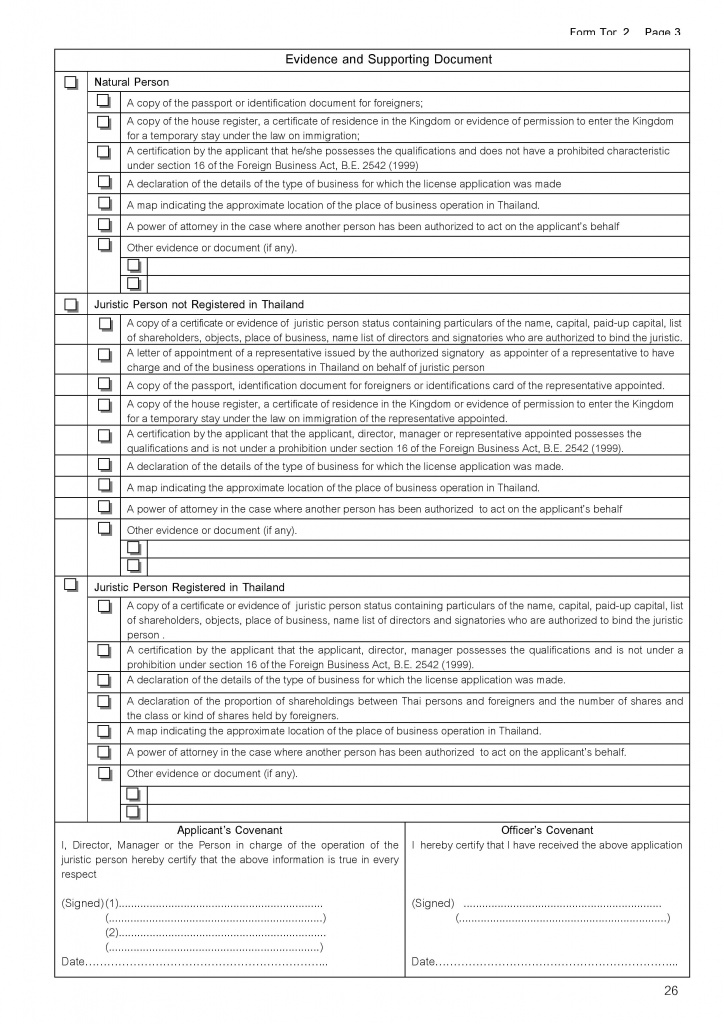

Apply for a foreign business license with Foreign Business Department, Department of Business Development An officer of Foreign Business Dept. informs that Bar/ caf restaurant is categorized under LIST THREE (19) Selling food or beverages in the Foreign Business Act B.E. 2542 (1999). Therefore, an investor must apply for a foreign business license under the section 17 (Please see the attached file of the Foreign Business Act B.E.2542, hi-light information). The procedure for applying the license is available on attached brochure. |

| 2 | Contact the city council of your area to ask for a permission to do construction/ use space/ land. | Business Registration with Department of Business Development, Ministry of Commerce |

| 3 | Apply a license for sell alcohol with Excise Department According to Thai’s Law, the license from excise dept. is required in order to sell alcohol. All the information about applying the license and related topic are available on the website:https://bit.ly/2ykRUtQ.(The information only available in Thai) | Contact the city council of your area to ask for a permission to do construction/ use space/ land. |

| 4 | - | Apply a license for sell alcohol with Excise Department |

Q1:

Q2:

A:

Any foreign company (Foreign Shareholding ratio is greater than 49%) who is willing to start up the business in Thailand with those business activities listed in List 2 of Foreign Business Act, B.E.2542 (1999) is needed to obtain the permission from the cabinet minister together with the permission from the relevant agency.

The relevant agency is "Department of Land Transport”. Referring to Land Transport Act B.E. 2522(1979), this act was enacted to regulate and monitor on the subject of road transport such as transport operation, operational license and control particular commercial vehicles (bus and truck).

Unofficial Translation

"Land Transport Act, B.E.2522 (1979)"

Chapter 3: Transport Operation

Section 24 (3) In case of Limited Company, ……..the investment capital of the company shall not be less than 51% of shareholders holding by natural persons with Thai nationality…….”

Thus, the company is needed to be Thai company to operate Land Transport business.

Land Transport Act, B.E.2522 (1979) only Thai version see via

http://web.krisdika.go.th/data/law/law2/%a111/%a111-20-9999-update.pdfSource: Foreign Business Administration Bureau

https://www.dbd.go.th/dbdweb_en/more_news.php?cid=246Department of Land Transport

http://www.dlt.go.th/th/

Definition of "Online Storage Service"

Online storage service is one of Internet services. This service provides data saving area in the Internet to user, user can upload and access his/her personal data with any devices, like PCs, smartphones, tablets.In fact, there are many online storage services in the world, many IT company join this market, such as Google ,Apple, Microsoft, and so on.

Q :

- Online data storage service:Online Storage is a browser-based application that allows user to store and access their data files (such as document, music, photos, etc.) safely and securely — online. e.g. "Drop Box" *We will not allow our customer (user) to

- share their files to the public. (To share with limited friends is partly allowed)

- download/use/save other user’s data (User’s data availability will be limited to their own files)

- Online Music/Contents StoreOnline music/contents store is an online business which sells movies, music and so on through the Internet. e.g. "iTunes"]

A : The officer from Foreign Business Administration explained that Online data storage service and Online Music/Contents Store business complied with Foreign Business Act section 17. Thus, the company can operate such services once the Foreign Business License (FBL) has approved.Please kindly access the attached files for your reference.

An officer from Foreign Business Department stated that guesthouse is categorized in the LIST THREE, Foreign Business Act B.E. 2542 (1999), under the article (17) Hotel business, except for hotel management service.

In order to operate Sea Plan Project in Thailand, investor must obtain two licenses as follow:

1. Air Operator License (AOL)

Importing wine is categorized in the LIST THREE, Foreign Business Act B.E. 2542 (1999), under the following articles, which depending on the company’s objective:

1. Foreign Business Act B.E.2542 (1999)2. Brochure of applying a license under Section 17. The contents inside includes procedure, document required, and suggestion.For more information regarding on relates issue,please access:https://www.dbd.go.th/dbdweb_en/ewt_dl_link.php?nid=4047

1. The paid up capital of the company operating ROH must be more than 10 Million baht or over at the end of each accounting period.

- At least two countries in the third and the fourth accounting periods- At least three countries from the fifth accounting period onwards

Please contact the Department of Primary Industries and Mines of Ministry of Industries for more information.For map and address,

There is a minimum salary required for a foreigner who works in Thailand, which is categories as the nationality. As shown in the Attached filed of rpt606EN.pdf (highlighted part)

An investor has to apply for permission to conducting sawmill as a license for transforming wood.First of all, an investor has to check the factory setup site with the Department of Public Works and Town & Country Planning first in order to ensure that the factory site is located in the allowance area for setting up a factory.

For inbound travel agency:

In order to operate this business in Thailand investor has to ask permission for a tourism license from the Department of tourism.An officer from the Department of Tourism stated that according to the Tourism Business and Guide Act B.E. 2551, under the section 17 shows the requirements for a limited to qualify as a tourism license is must be a juristic person under Thai law who intended to carry out business related to tourism. If a registered partnership who is non partner’s liability must be Thai nationals.In the case of partnership or limited company, the share capital of not less than fifty percent is required individuals who are Thai nationals. And more than half of the company's directors must be Thai nationals. (Please see attached file of "Tourism Business and Guide Act", hi-light information)