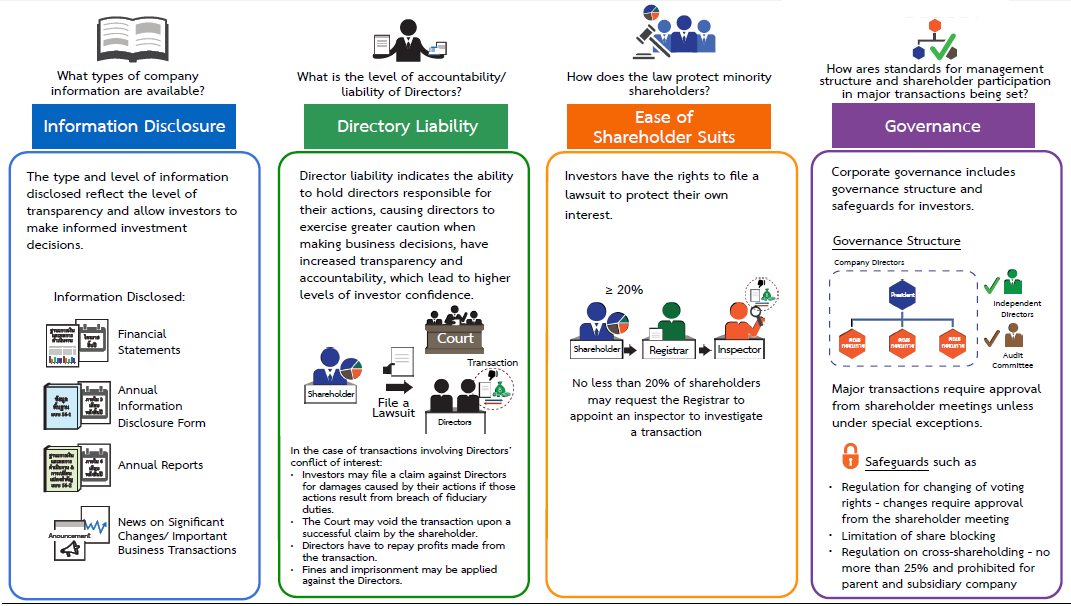

Protecting Investors

This section discusses the rights and protection of investors when investing in publicly traded and listed companies. Regulations for protecting minority shareholders usually centre around disclosure of information, director accountability and practices on related-party transactions, shareholder participation, good governance and other safeguards for investors.

Useful Information for Investor Protection:

Select your options

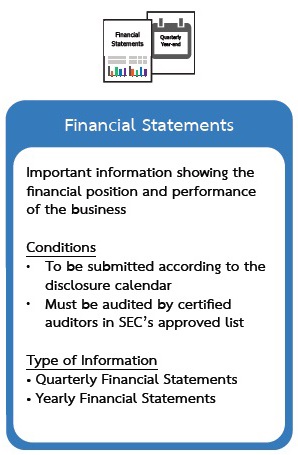

Financial Statements

- To be submitted according to the disclosure calendar

- Must be audited by certified auditors in SEC's approved list

- Quarterly Financial Statements

- Yearly Financial Statements

Last updated 17 May 2015

Source :

| SET: Rules divided by information disclosure category | link |

| SEC: Financial statement & report under Section 56 | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| SEC: Securities and Exchange Act B.E. 2535 | link |

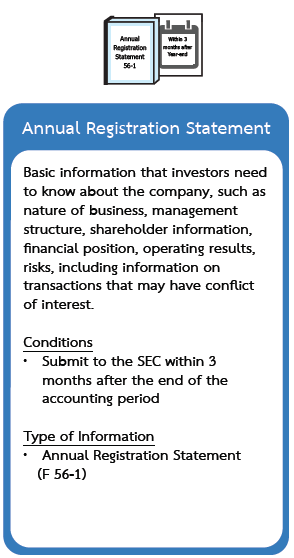

Annual Registration Statement

- Submit to the SEC within 3 months after the end of the accounting period

- Annual Registration Statement (F 56 - 1)

Last updated 17 May 2015

Source :

| SET : Disclosure Guideline for Listed Companies Management | link |

| SEC : Annual Registration Statement (Form 56-1) | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| SEC: Securities and Exchange Act B.E. 2535 | link |

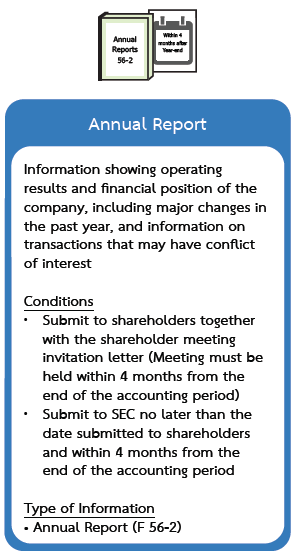

Annual Report

- Submit to shareholders together with the shareholder meeting invitation letter (Meeting must be held within 4 months from the end of the accounting period)

- Submit to SEC no later than the date submitted to shareholders and within 4 months from the end of the accounting period

- Annual Report (F 56 - 2)

Last updated 17 May 2015

Source :

| SET : Periodic Information Disclosure | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| SEC: Securities and Exchange Act B.E. 2535 | link |

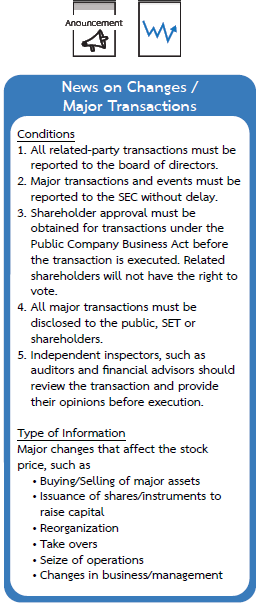

News on Changes / Major Transactions

- All related-party transaction must be reported to the board of directors.

- Major transactions and events must be reported to the SEC without delay.

- Shareholder approval must be obtained for transactions under the Public Company Business Act before the transaction is executed. Related shareholders will not have the right to vote.

- All major transactions must be disclosed to the public, SET or shareholders.

- Independent inspectors, such as auditors and financial advisors should review the transaction and provide their opinions before execution.

Major changes that affect the stock price, such as

- Buying / Selling of major assets

- Issuance of shares / instruments to raise capital

- Reorganization

- Take overs

- Seize of operations

- Changes in business / management

Last updated 17 May 2015

Source :

| SET : Information for Listed Companies | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| SEC: Securities and Exchange Act B.E. 2535 | link |

Select your options

Directors Liability

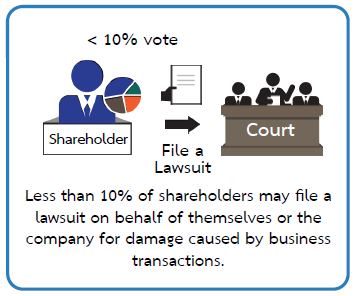

Less than 10% of shareholders may file a lawsuit on behalf of themselves or the company for damage caused by business transaction.

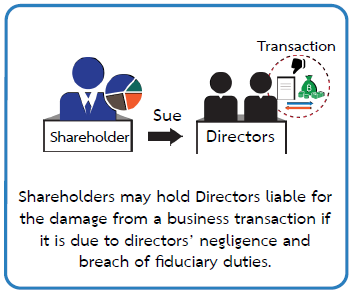

Shareholders may hold Directors liable for the damage from a business transaction if it is due to director's negligence and breach of fiduciary duties.

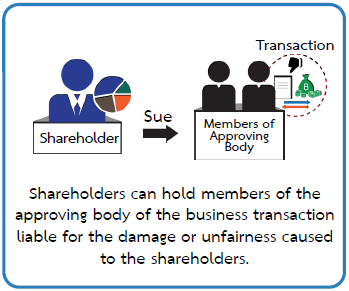

Shareholders can hold members of the approving body of the business transaction liable for the damage or unfairness caused to the shareholders.

The court can void transactions that cause damages to the shareholders as a result of Directors's breach of duty.

Directors need to pay for damages for the harm caused to the company upon a successful claim by the shareholder.

Directors need to repay the profits made from the transaction upon a successful claim by the shareholder.

Fines and Imprisonment can be applied against directors.

Last updated 17 May 2015

Source :

| SEC: Plan Prepare and Plan Administrator (Form 59) | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| SEC: Securities and Exchange Act B.E. 2535 | link |

Select your options

Ease of Shareholder Suits

Shareholders have the following rights:

A shareholder may request to examine the company's balance sheet, income statement and auditor's report.

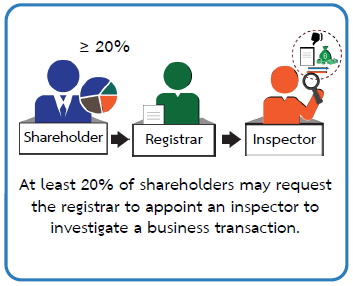

At least 20% of shareholders may request the registrar to appoint an inspector to investigate a business transaction.

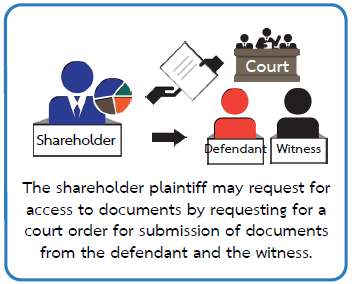

The shareholder plaintiff may request for access to documents by requesting for a court order for submission of documents from the defendant and the witness.

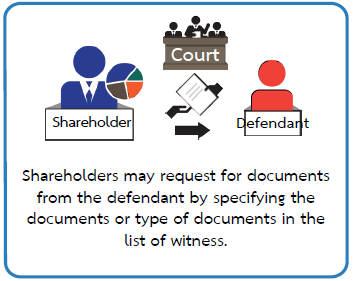

Shareholders may request for documents from the defendant by specifying the documents or type of documents in the list of witness.

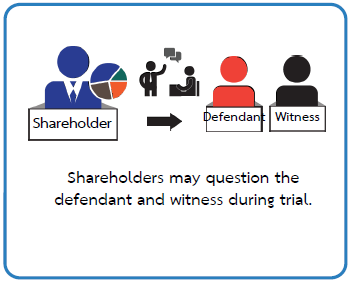

Shareholders may question the defendant and witness during trial.

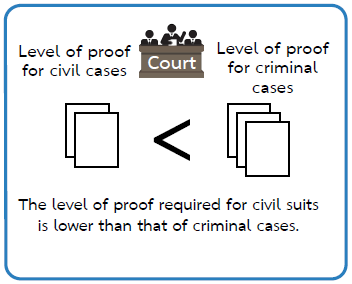

The level of proof required for civil suits is lower than that of criminal cases.

Last updated 17 May 2015

Source :

| SEC : Director’s Handbook | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| LED: Act Amending The Civil Procedure Code (No. 30) B.E. 2560 | link |

Select your options

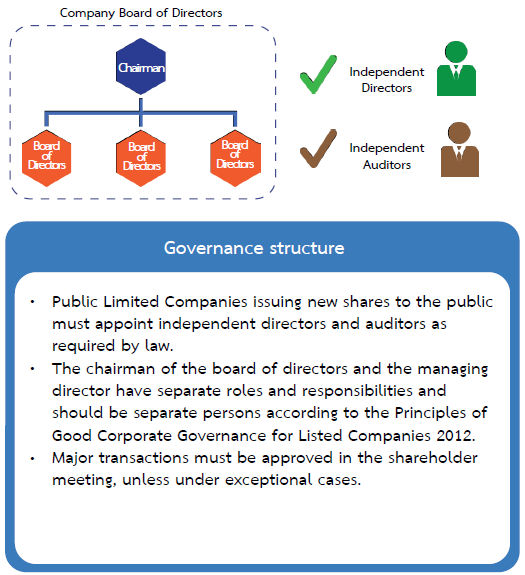

Governance structure

- Public Limited Companies issuing new shares to the public must appoint independent directors and auditors as required by law.

- The chairman of the board of directors and the managing director have separate roles and responsibilities and should be separate persons according to the Principles of Good Corporate Governance for Listed Companies 2012.

- Major transaction must be approved in the shareholder meeting, unless under exceptional cases.

Last updated 17 May 2015

Source :

| SEC : Corporate Governance Code 2017 | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| SEC: Securities and Exchange Act B.E. 2535 | link |

| SET: The Principles of Good CorporateGovernance for Listed Companies | link |

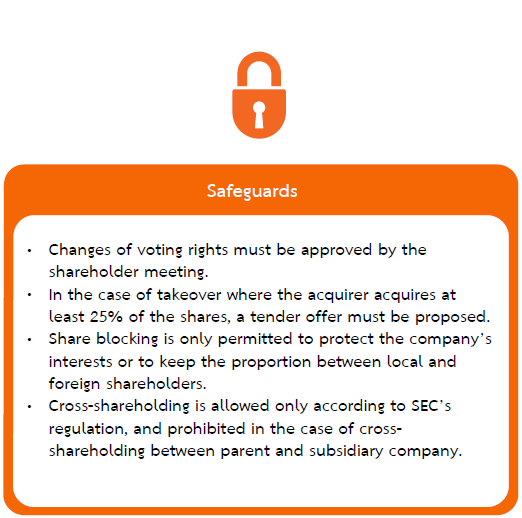

Safeguards

- Changes of voting rights must be approved by the shareholder meeting.

- In the case of takeover where the acquirer acquires at least 25% of the shares, a tender offer must be proposed.

- Share blocking is only permitted to protect the company's interest or to keep the proportion between local and foreign shareholders.

- Cross-shareholding is allowed only according to SEC's regulation, and prohibited in the case of cross-shareholding between parent and subsidiary company.

Last updated 17 May 2015

Source :

| SET : Corporate Governance and Firm Performance: the Case of Thailand | link |

| DBD: Public Limited Companies Act B.E. 2535 | link |

| SET: The Principles of Good CorporateGovernance for Listed Companies | link |

| SEC: Securities and Exchange Act B.E. 2535 | link |