Resolving Insolvency

When facing insolvency, businesses may go through bankruptcy or reorganization. This section discusses the procedures, time and costs using a case study to provide investors with a general understanding of the bankruptcy and reorganization process.

Sample case :

The Debtor is a Thai Hotel, experiencing a decrease in revenue

There are two types of credits:

1. The Bank - 74% of total debt. The debtor uses all of its assets to secure the loan. The market value of assets is equal to the loan amounts.

2. Other Creditors - 26% of the dept. (suppliers, employees). These are unsecured creditors.

If the business is sold as a going concern, the value will be 100% of market value, but if sold as peicemeal, it will receive 70% of market value. Therefore the most likely outcome is reorganization or selling of the business as a going concern.

The time indicated is an average figure.

Select your options

Filling of Bankruptcy Petition

- The amount received from liquidation of secured assets is inadequate, and other assets can be seized, such as cases for secured creditors that are under the contract to be exempted from Civil and Commercial Code, Section 733 which states that the debtor is not liable for the difference if the value of the property / net proceeds is less than the amount due.

- The debtor still owes the creditor no less than 1 Million Baht (Ordinary Person) or 2 Million (Juristic Person) after the creditor has given up the collateral, or when the value of the collateral in the claim is less than the amount owed.

- the type of case - whether involving any assets.

- the number of creditors.

- cooperation from creditors in the case of no objection to the Official Receiver's orders.

- time before the assets can be sold.

Source :

| Bankruptcy Office: Bankruptcy proceedings | link |

| Legal Execution Department: Bankruptcy Procedure Procedure | link |

| Central Bankruptcy Court: Download the printed form of the Central Bankruptcy Court | link |

Complaint Acceptance & Trial

When there is indication of assets misappropriation, the creditor may request the court for temporary attachment of assets.

Source :

| Central Bankruptcy Court: Information system for searching bankruptcy cases | link |

Issuing Order of Absolute Receivership

The Official Receiver :

- Is a civil servant under the Legal Execution Department, Ministry of Justice.

- Has the duty to manage the debtor's assets in bankruptcy cases in the interest of the creditors.

- The Official Receiver has to convene the first creditor meeting at the soonest occasion to decide on the option of composition, or to ask the court to issue a bankruptcy order. The Official Receiver has to publicize the meeting date in at least one daily newspaper, and inform the debtor and all creditors.

- The creditors must file for debt repayment with the Official Receiver within two months from the publication date.

- The debtor has to meet with the Official Receiver to provide assets information for investigation, and has the right to request for composition.

Source :

| Central Bankruptcy Court: Information system for searching bankruptcy cases | link |

Public Examination of Debtor & Bankruptcy Adjudication

Announce Creditor and Debtor Appointment / Publish in at least one daily newspaper.

Source :

| Central Bankruptcy Court: Information system for searching bankruptcy cases | link |

Liquidation of Assets

Source :

| Central Bankruptcy Court: Information system for searching bankruptcy cases | link |

Select your options

Application for Reorganization

Source :

| Central Bankruptcy Court: Download documents forms printed forms rehabilitation cases | link |

| Legal Execution Department: Procedures and process of rehabilitation of debtors | link |

| Central Bankruptcy Court: Requesting business rehabilitation | link |

| Legal Execution Department: various forms Of the debtors business rehabilitation office | link |

Complaint Acceptance & Trial

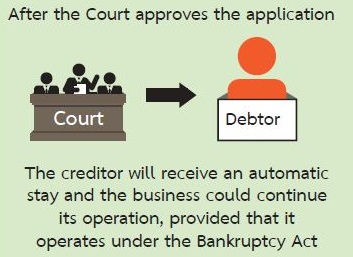

After the Court approves the application

Source :

| Legal Execution Department: Case Inquiry System | link |

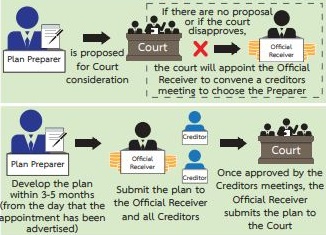

Order for Reorganization and Appointment of Plan Preparer

2. Is 25 year old and older on the registered date.

3. Complete a Bachelor Degree or equivalent.

- Plan Preparer - possess a degree and at least 3 year experience in Finance, Accounting or Law.

- Plan Administrator - possess the qualification and at least 3 years experience in Business Administrator.

Source :

| Legal Execution Department: Case Inquiry System | link |

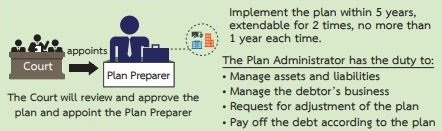

Approval of Plan and Appointment of Plan Administrator

- Manage assets and liabilities.

- Manage the debtor 's business.

- Request for adjustment of the plan.

- Pay off the debt according to the plan.

Source :

| Legal Execution Department: Case Inquiry System | link |